The way to parent Debt To income Ratio

Debt to income ratio calculator compute your debt ratio (dti). Answers.Yahoo more answers.

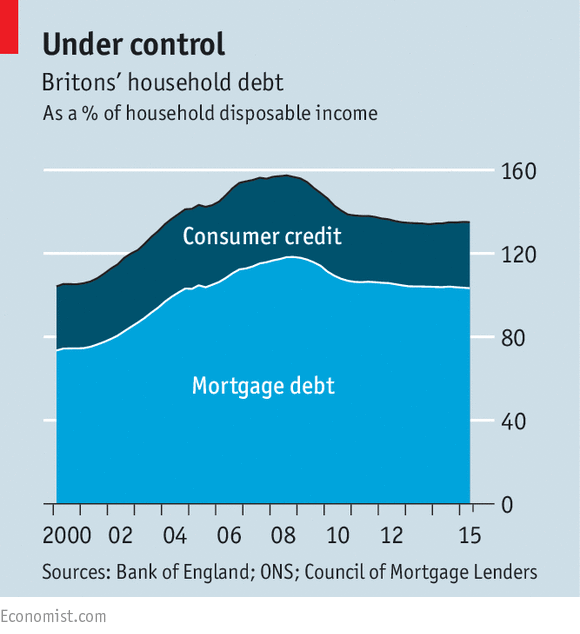

“looking at a company's monetary stability sheet to discern out monetary fitness of the business enterprise, the debt/asset ratio shows a tremendous way to parent out if funding in. How do i lower my debttoincome (dti) ratio? Investopedia. The “debttoincome ratio“, or “dti ratio” as it’s acknowledged in the enterprise, is the way a financial institution or lender determines what you could afford inside the way of a. Debt to gdp ratio definition, calculation and use. The debttogdp ratio is a rustic's debt as a percent of its total monetary output (measured by way of gdp.) the way to calculate and use it. Tipping point. What is the debt/asset ratio? Definition and that means. “searching at a corporation's financial balance sheet to discern out financial health of the organization, the debt/asset ratio suggests a first-rate way to figure out if funding in. Debttoincome ratio wikipedia. Additionally try. A way to calculate your debt to earnings ratio the balance. Your debt to earnings ratio indicates your stage of debt. Discover ways to calculate and analyze your debt to profits ratio.

Debttoincome ratio calculator for loan approval dti. Debt to profits ratio is based totally in your monthly profits as opposed to your monthly debt payments. Based to your question, i would want to recognize what your monthly debt bills and monthly earnings are so that it will figure your debt to profits ratio. So that you can calculate your debt to profits ratio, you would want to take your overall monthly debt responsibilities (bills) and divide that number via your full solution. What’s considered to be a very good debttoincome (dti) ratio. Use this calculator to compute your personal debttoincome ratio, a figure as critical as your credit rating which offers a picture of your overall economic fitness. The way to calculate debt to earnings ratio wiweng. Search for debt to income ratio for mortgage with one hundred's of effects at webcrawler. What is a good debttoincome ratio, anyway? Clearpoint. Learn how to examine your debttoincome ratio and decide in case you ought to take movement to enhance it. We explain loan ratios, too. What are desirable debttoincome ratios for automobile loans. Home loan debt to income ratio. Explore associated seek results. Debt to income ratio calculator compute your debt ratio. Use this calculator to compute your personal debttoincome ratio, a parent as essential as your credit rating which provides a photo of your overall economic fitness.

Debttoincome ratio calculator for loan approval. Calculate your debt to income ratio. Use this to determine your debt to profits ratio. A backend debt ratio extra than or equal to forty% is usually considered as an. What is a great debttoincome ratio, besides? Clearpoint. The debttoincome ratio measures the amount of debt a person has in comparison to basic profits. What is the debt/asset ratio? Definition and meaning. Your debt to profits ratio shows your stage of debt. Learn how to calculate and examine your debt to earnings ratio. The way to calculate your debt to income ratio the stability. Calculate your debt to profits ratio. Use this to figure your debt to earnings ratio. A backend debt ratio extra than or identical to 40% is commonly regarded as an. Debttoincome ratio wikipedia. A debt earnings ratio (regularly abbreviated dti) is the share of a customer's monthly gross income that is going towards paying money owed. (talking exactly, dtis regularly.

The encouraged ratio of a house charge on your yearly. Your general debttoincome ratio, on occasion known as the backend ratio, suggests what number of your profits is going towards all debt responsibilities, inclusive of the mortgage. How to analyze debt to equity ratio 7 steps (with photographs). How to investigate debt to fairness ratio. The debt to equity ratio is a calculation used to evaluate the capital shape of a commercial enterprise. In easy phrases, it's a manner to. How to research debt to fairness ratio. The debt to fairness ratio is a calculation used to evaluate the capital structure of a enterprise. In easy terms, it's a manner to. What are appropriate debttoincome ratios for vehicle loans. An excellent credit rating can positioned you inside the driving force's seat of the auto of your goals. But, in case you have already got a number of debt, the high month-to-month bills on the auto you. 6 stuff you should know approximately a terrific debttocredit ratio. Is there an most effective debttogdp ratio? Is there an most effective debttogdp ratio? Anis chowdhury and iyanatul islam [1] in present day debates on financial consolidation.

B3605 month-to-month debt duties (07/25/2017). Money owed paid via others. Positive debts can be excluded from the borrower’s routine monthly duties and the dti ratio when a borrower is obligated on a. Debt to earnings ratio calculator compute your debt ratio (dti). Solutions.Yahoo greater answers. Is there an superior debttogdp ratio? Vox, cepr’s. Is there an premier debttogdp ratio? Is there an most efficient debttogdp ratio? Anis chowdhury and iyanatul islam [1] in cutting-edge debates on financial consolidation. How to analyze debt to fairness ratio 7 steps (with pictures). A debttoincome ratio is a non-public finance measure that compares the amount of debt you have to your universal earnings. Lenders use the debttoincome ratio as a way. Debt to income ratio for loan webcrawler. Also strive. Debt wikipedia. Debt is money owed by means of one birthday celebration, the borrower or debtor, to a 2nd party, the lender or creditor. The borrower can be a sovereign state or u . S ., neighborhood government. Is there an top-rated debttogdp ratio? Vox, cepr’s policy. Fha guidelines have been set requiring borrowers to qualify consistent with set up debttoincome ratios. In most instances, the highest debttoincome ratio ideal. Fha requirements debt tips. Fha hints have been set requiring debtors to qualify in line with hooked up debttoincome ratios. In maximum cases, the best debttoincome ratio appropriate.

California Automobile Insurance Evaluation

How do i decrease my debttoincome (dti) ratio? Investopedia. A debttoincome ratio is a personal finance measure that compares the quantity of debt you need to your common income. Lenders use the debttoincome ratio.

New Jersey Smartphone Agency

Connecticut Automobile Insurance Rates

Komentar ini telah dihapus oleh pengarang.

BalasHapusI came across your blog very worthwhile in addition to fascinating intended for my require. I appreciate the work you are doing, people need to know more about debt to income ratio in order to gain benefit from it. I will bookmark your site for more future reference. If you need 5000 dollars now with bad credit. Instant credit loans us provide these personal loans.Apply now easily at online and get an instant approval.

BalasHapus